Extreme Volatility Hits CBOT as Russian Military Invades Ukraine; Matif Wheat Trades an All-Time High

So much for Mr nice guy, Putin has gone all out and is basically daring NATO to send some troops into harms way. Looks to us like that organization hasn’t learned much from the late 30’s and German expansionist policies and is prone to make the same mistake all over again. Frightening, but it seems like perceived-as-crazy Presidents like Trump and Reagan scared off the Russians just by being unpredictable. Now, we have talkers that the Russian president isn’t concerned with at all. Just our take on it, which would mean his expansionist ideas could grow over coming weeks and months, not be tempered.

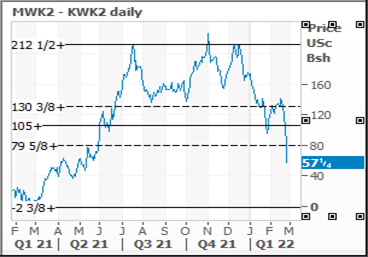

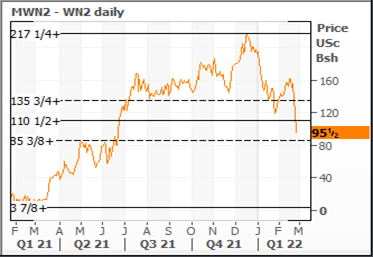

The early limit up price action in all but soybeans was NOT a static limit up day in the end. Matif wheat was as much as 47.75 Euros higher, that’s around 125 US cents. That’s a lot. But it didn’t hold in that market, finishing “just” 21 Euros higher in May22. Still a new all time high finish ever in Euros, however. US winter wheats mainly held at or near limit up, one scary drawdown early in the session but otherwise strong towards limit up and strong calendar spreads also. MGE wheat was a follower up only 30 in the front and 15 in MWK and just slightly higher in new crop months late in the session. That’s a far cry from the 99 cent higher MWH22 overnight tick that also produced a 32 inverse MWH/MWK. Frankly the MGE wheat is all over the place and shouldn’t be trusted. But please note that in the end the MWH-MWK was up 12 cents at 10 inverse, somehow MWK-MWN was only up 6 at 8 inverse, and illiquid MWN-MWU (last old crop spring wheat month vs first new crop month) had a 26 cent range from 1 lower to 25 higher and finished at 38 inverse up 13 cents. There was one early in the day 30 minute window where the MWN-MWU spread moved up to 47 inverse and back down to the mid 20’s. Certainly a bunch of pushing and pulling going on, some get me out trade in an illiquid market also, also some talk of some farmer selling today dampening things. Makes sense to a degree with the winter wheats limit up and the problem with Black Sea being winter wheat also, it leaves MGE wheat in an unplanted quandary of what to do. Some think there will be more farmer selling of on farm stocks here at current prices to refill the pipeline yet again, others point to everyone’s balance sheet numbers taken off the USDA numbers and call BS, that it’s all gone and we are about to explode MGE wheat to the upside as the same situation as the Canadian stocks plays out, a quick break in the numbers from the current decent levels to reality. A real gamut of opinions and nobody is quite sure who is right yet. That leaves the market thin and prone to being shoved around. Many are now eyeing MGE-KW relationship in different timeslots and thinking that maybe the break has gone far enough to stimulate big domestic mill buying of spring wheat from here on out. If true, there’s upside to Minney from here. We take it a step further and wonder about MWN old crop vs what seems to be a US SRW new crop that’s in great shape and would like to point out the MWN22-WN22 has broken nearly as far and possibly could be a buy around 85 over which it is rapidly approaching. Why even mess with the potentially dry HRW when a similar trade is available for MGE old crop vs the much better shape new crop SRW? Just our thoughts, although we caution to splash in very carefully to hard/soft inters in this environment.

Soybeans gave up before the day was over, down 13.5 cents in front March and very importantly down 35 cents in back new crop SX late in the day. This may have something to do with the US Ag outlook forum that said 92.0 million corn acres vs 93.4 last year and 88 million soybean acres vs 87.2 in 2021. Food for thought, the market seemed to be happy enough with those figures to sell off the new crop pretty hard. We find that thinking a little odd as some analysts had expected close to evens on the two, which would have been nearly historic.

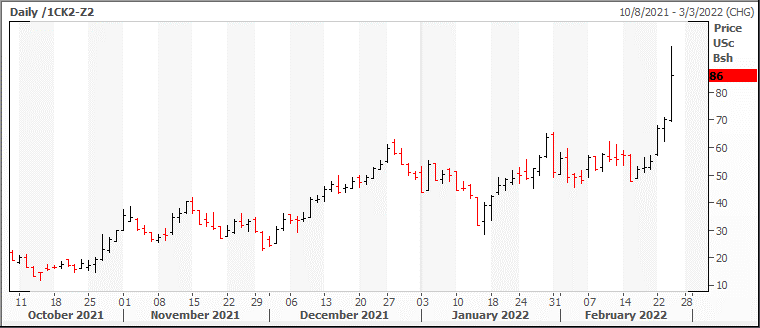

Corn finished “only” 7 higher in front CH, 6 lower in back CZ. Right in the middle of the days range in the front and still off to the races on the daily chart upside while only 2/3 of the way to the old 2021 highs and room beyond that to the 2012 highs on the monthly chart. Corn cal spreads were reasonably strong, with CK22-CZ22 looking like this, look out:

More new sanctions announced from Biden towards Russian institutions today seemed to have some impact as traders seemed to want to suddenly take more profits on longs. Tomorrow AM we get delayed weekly US export sales, cant imagine that can move markets much. We also have first intentions for March ags tomorrow on the close, that will be a big moment for Chicago wheat cal spreads and maybe the row crops also. Then it’s a long wait over the weekend to see what happens next. Volatilities on options are much higher than a day ago, but not yet historically high. Nevertheless, we would recommend spreads that mitigate vega risk at this point if buying options, and we think we are getting close to being able to try the sell side of options if you are able to originate the short through call sales or originate the long through puts sales and really mean it and wont barf the options if it actually goes through your strike. Not quite there yet but getting close. Chicago wheat May options at 45 for implied vol at the money. With WK at 932 that puts the atm straddle at 131 settled. With just 57 days to expiration, an awful lot of premium to overcome. That said, limits tomorrow are 75 cents in Chicago and KC wheat, 60 in Minney. Starting tonight there are no limits on the front March ags as it is officially in delivery. Food for thought. Probably going to be pretty hard to make massive gains buying naked calls from these vols unless you believe there are dollars more of upside. For example, the WK 1100 calls were 21 bid at 25 on the close. That’s an awful lot of premium to lay out for a call that’s a dollar seventy out of the money with 57 days left.